The Biden administration revealed on Friday an extra $7.4 billion in student loan cancellations for approximately 277,000 borrowers, expanding on earlier plans to

provide debt relief for millions of borrowers by fall, pending approval of new regulations proposed by the White House.

This incremental approach reflects the administration's strategy of targeting specific subsets of borrowers with smaller actions, aiming for a cumulative impact after a Supreme Court ruling last year struck down a larger $400 billion debt forgiveness plan.

This move also coincides with President Biden's efforts to garner support from young voters, who are disproportionately affected by soaring education costs but may be disillusioned by his policies on Israel and the Gaza conflict.

Combined with previous measures, Friday's announcement brings total forgiven debt to $153 billion, benefiting approximately 4.3 million borrowers to date. The administration aims to forgive loans held by around 30 million borrowers in total, with 277,000 individuals being notified of their eligibility via email.

Education Secretary Miguel A. Cardona stated, “We’ve approved help for roughly one out of 10 of the 43 million Americans who have federal student loans.”

The latest round of cancellations covers three categories of borrowers eligible under existing programs. The majority of forgiveness, around 207,000 individuals, will go to borrowers with debts of $12,000 or less enrolled in the administration’s income-driven repayment plan, SAVE. Another 65,000 borrowers in repayment plans will see reductions due to corrections for administrative and servicing errors. The remaining group will have their loans forgiven through the Public Service Loan Forgiveness Program after meeting the 10-year requirement of payments while engaged in public service.

The administration's approach follows a study of the Supreme Court's decision and seeks to identify specific groups eligible for cancellation under established laws like the Higher Education Act.

Despite these efforts, Republican opposition to Biden’s plans persists, with legal challenges from state-level officials and criticism in Congress. Economic analyses suggest that the SAVE plan could cost the government up to $475 billion over the next decade.

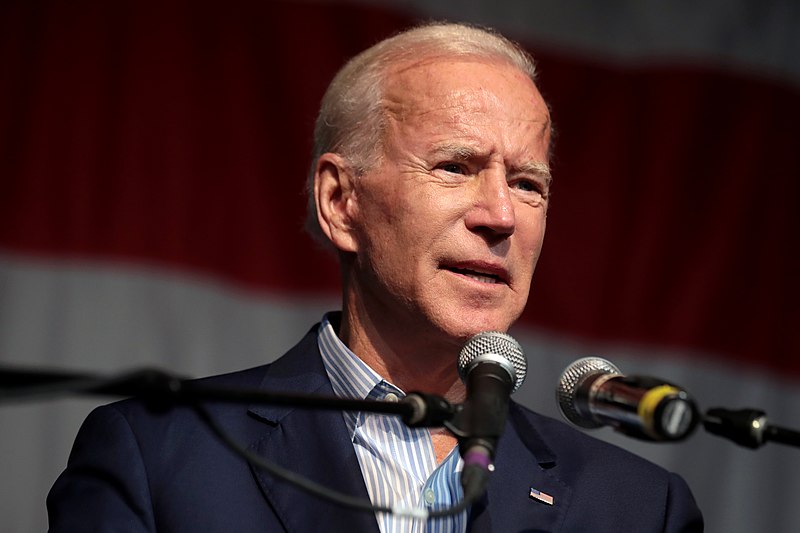

The administration faces challenges in balancing assistance for struggling borrowers while addressing concerns over fairness for those who repaid their loans without aid. Yet, Mr. Cardona contends that the administration's improved repayment plans aim to prevent future loan forgiveness needs. Photo by Gage Skidmore from Peoria, AZ, United States of America, Wikimedia commons.