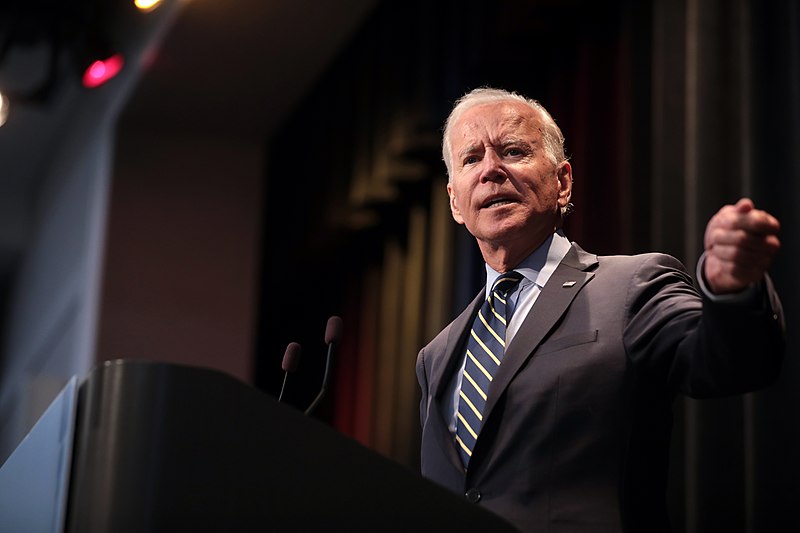

"The United States experiences faster-than-anticipated growth in the third quarter, attributed to increased spending by the Joe Biden administration.

Economic growth in the US reached 5.2% between July and September, surpassing earlier projections of 4.9%. While consumer spending expanded, it did so at a rate slightly lower than anticipated, standing at 3.6%. This sparked a surge in both stock and bond markets, indicating the likelihood of the Federal Reserve initiating interest rate cuts soon.

The two-year US Treasury bond yield hit its lowest point since July at 4.66%, with Wall Street stocks making notable gains.

Joe Biden's Inflation Reduction Act, which allocates green subsidies to US-based companies, is set to inject an additional $260 billion into government spending over the next decade.

The markets have priced in an expected decrease in US interest rates by May, especially after Fed Governor Christopher Waller, known for his more conservative stance, suggested potential rate cuts if inflation continued to ease.

Simultaneously, bond yields in the eurozone are on the decline, influenced by lower-than-projected inflation rates in Germany. This development led to a 1% surge in Germany's DAX stock index, reaching a four-month high." Photo by Gage Skidmore from Peoria, AZ, United States of America, Wikimedia commons.