The Biden administration announced a comprehensive overhaul of student loan repayment plans on Tuesday, with the aim of enhancing affordability by reducing monthly

payment obligations and curtailing accrued interest.

According to the White House and the Department of Education, the proposed changes could lead to savings of up to $1,000 annually for the typical borrower. For individuals who have taken out loans to fund their education at a four-year U.S. public college or university, the savings could amount to approximately $2,000 each year. These alterations are poised to impact a considerable number of Americans, as they open eligibility to enroll in the new plan for tens of millions.

President Joe Biden remains committed to implementing far-reaching student debt relief initiatives, despite some legal challenges faced by certain aspects of his proposals. The U.S. Supreme Court's decision in June prevented the enactment of a rule designed to eliminate $430 billion in student loan debt for around 43 million borrowers. Similarly, a federal appeals court recently halted another rule that aimed to simplify the loan forgiveness process for students deceived by for-profit colleges.

Amid the economic upheaval caused by the COVID-19 pandemic, student loan payments were temporarily suspended. However, these payments have since resumed. As Biden eyes a second term in the November 2024 election, he continues to prioritize strengthening the nation's economy as a key pillar of his domestic agenda.

The newly introduced Saving on A Valuable Education (SAVE) income-driven repayment plan intends to significantly reduce the financial burden on qualified borrowers. Undergraduate loan holders will witness their monthly payment obligations drop from 10% to 5% of their discretionary income. Additionally, the new plan will extend no monthly payment options to an estimated 1 million low-income borrowers.

Furthermore, the revised repayment structure will prevent loan balances from accruing interest if borrowers adhere to the stipulated monthly payment requirements. For those who meet the criteria, loan forgiveness could be attainable in as little as a decade, a marked improvement from the 20 to 25 years stipulated in prior income-driven plans.

The White House emphasized its commitment to swiftly delivering student debt relief to a wide spectrum of Americans through alternative strategies. The new plan, the statement highlighted, will prove especially beneficial for low- and middle-income borrowers, students attending community colleges, and individuals engaged in public service.

The Department of Education echoed these sentiments, noting that the plan will play a pivotal role in supporting diverse segments of the student population. Specifically, it is anticipated to halve the total lifetime payments for Black, Hispanic, American Indian, and Alaska Native borrowers.

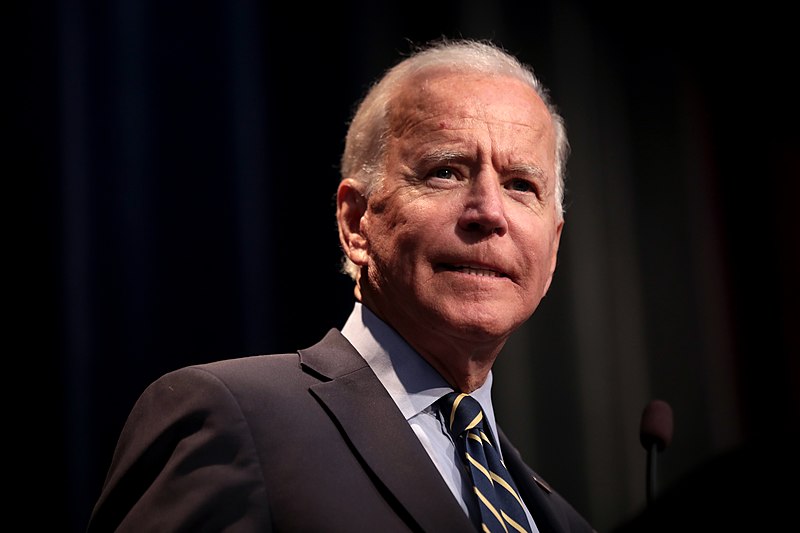

Recent data, released earlier this month, indicated a decrease of $35 billion in student loan balances during the second quarter, with the overall outstanding student loan debt amounting to $1.57 trillion. Photo by Gage Skidmore from Peoria, AZ, United States of America, Wikimedia commons.